nh food tax calculator

New Hampshire Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income. Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8.

New Hampshire Unemployment Insurance.

. Exact tax amount may vary for different items. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Hanover Co-op Food Store. Take the purchase price of the property and multiply by 15. North Main Street Colebrook NH 03576.

However there are limited exemptions for instrumentalities of the State of New Hampshire the federal government schools and medical facilities. 378 South Main Street Laconia NH 03246. Please note state sales tax rate might change and the default sales tax for this calculator does not include local tax rate.

Use this app to split bills when dining with friends or to verify costs of an individual purchase. Sole traders self employed receive additional tax credits lowering the total amount of tax paid. In NH transfer tax is split in half by buyer and seller.

0 5 tax on interest and dividends Median household income. New Hampshire Gas Tax. Meals paid for with food stampscoupons.

This is the 24th-highest cigarette tax in the US. Census Bureau Number of cities that have local income taxes. Maryland Food for immediate consumption is taxable.

A calculator to quickly and easily determine the tip sales tax and other details for a bill. Select State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa. Find out if you may be eligible for food stamps and an estimated amount of benefits you could receive.

Food Stamp Calculator Use the federal food stamp calculator to estimate the amount of benefits you may receive based on income expenses and family size. The New Hampshire bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. 12C Main Street Center Harbor NH 03226.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. New Hampshire Paycheck Quick Facts. Learn how to apply for assistance check eligibility track your application status and more.

Simply enter the costprice and the sales tax percentage and the NH sales tax calculator will calculate the tax and the final price. Massachusetts Food for immediate consumption which includes food sold by a restaurant even if to go is taxable. The new hampshire income tax calculator is designed to provide a salary example with salary deductions made in.

34 Cypress Street Keene NH 03431. To include local tax rate into calculation simply change the rate. As an employer youre responsible for paying unemployment insurance.

45 South Park Street Hanover NH 03755. This is an unofficial calculator and not an application. New Hampshire is one of the few states with no statewide sales tax.

Designed for mobile and desktop clients. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. New hampshire personal income tax.

Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives House Bill 1590 - License. That tax applies to both regular and diesel fuel. Last updated November 27 2020.

New Hampshires income tax is pretty simple with a flat rate of 5 and no local income taxes. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Divide the total transfer tax by two.

New Hampshire income tax rate. This tax is not paid directly by the consumer. 77 Main Street Lancaster NH 03584.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. You can read Maines guide to sales tax on prepared food here. After much consideration and review the tax deadline for the state of new hampshire will remain april 15 2021.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. NH EASY Gateway to Services New Hampshires Electronic Application System. New Hampshire Cigarette Tax.

New Hampshires excise tax on cigarettes totals 178 per pack of 20. 2022 New Hampshire state sales tax. If you have any questions about tax exempt sales please call the Department for clarification at 603 230-5920.

The gas tax in New Hampshire is equal to 2220 cents per gallon. While its not a fun number to calculate your portion of the transfer tax will be accounted for on your closing disclosure when you receive your final numbers. Nh Food Tax Calculator October 9 2021 calculator food 77 main street lancaster nh 03584.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Your average tax rate is 222 and your marginal tax rate is 361this marginal tax rate means that your immediate additional income will be taxed at this rate. Please refer to the NH Code of Administrative Rules Rev 702 for criteria.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Hampshire local counties cities and special taxation districts. New Hampshire Hourly Paycheck Calculator. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

There are however several specific taxes levied on particular services or products. A calculator to quickly and easily determine the tip sales tax and other details for a bill. This New Hampshire hourly paycheck calculator is perfect for those who are paid on an hourly basis.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Free calculator to find any value given the other two of the following three. Using deductions is an excellent way to reduce your New Hampshire income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and New Hampshire tax returns.

Georgia Sales Reverse Sales Tax Calculator Dremploye

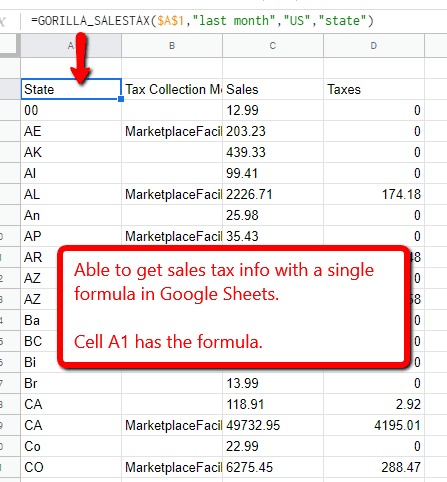

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

States With Highest And Lowest Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Income Tax Calculator 2020 2021 Estimate Return Refund

Tax Calculation Spreadsheet Excel Spreadsheets Budget Spreadsheet Spreadsheet

Tax Calculator App Calculator App App Calculator

Stop Overspending For Good Overspending Frugal Personal Financial Planning

Woocommerce Sales Tax In The Us How To Automate Calculations

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Lesson For Kids Study Com

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

The Consumer S Guide To Sales Tax Taxjar Developers

Self Employed Tax Calculator Small Business Bookkeeping Business Tax Self Employment

Tennessee Sales Tax Small Business Guide Truic

Woocommerce Sales Tax In The Us How To Automate Calculations